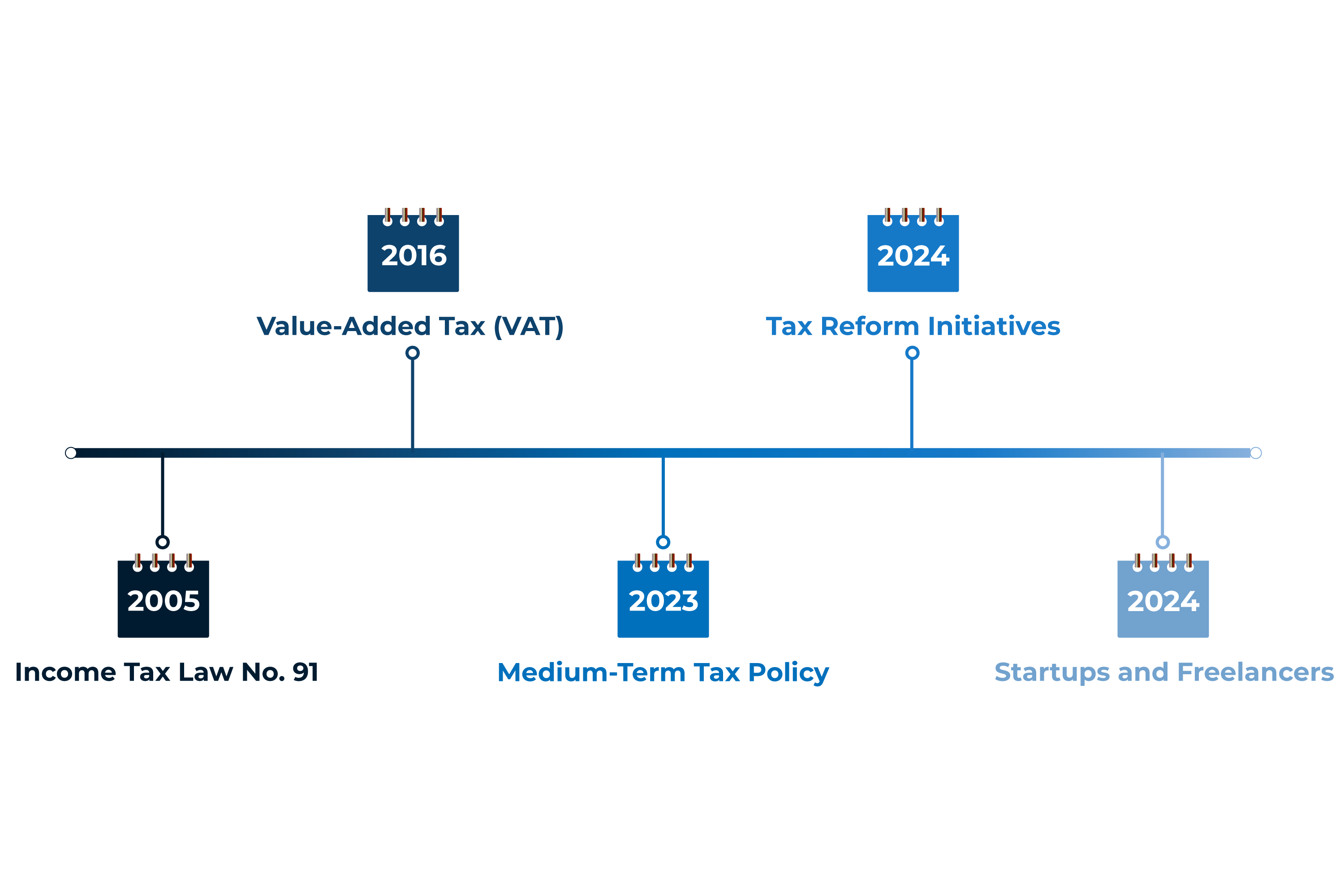

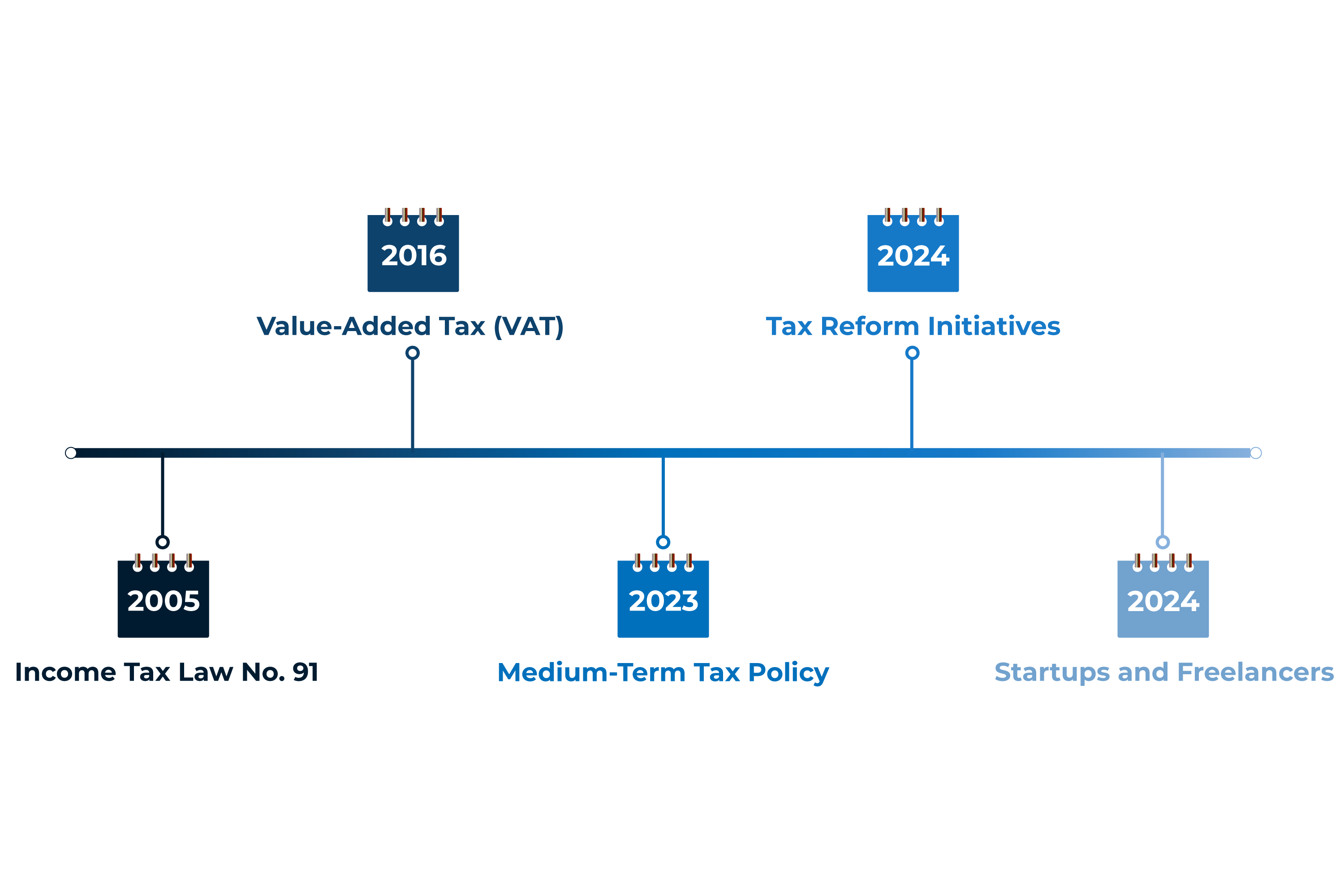

Egypt has recently undertaken significant tax reforms aimed at promoting economic growth, enhancing compliance, and simplifying tax processes. These reforms are designed to foster a more business-friendly environment, encouraging both local and foreign investment. However, they also present challenges for businesses that need to adapt to new regulations and ensure compliance. In this post, we’ll explore the key tax reforms in Egypt and how they impact businesses across various sectors.

Overview of Key Tax Reforms

Egypt’s tax reform efforts have focused on improving transparency, reducing administrative burdens, and creating a more favorable business environment. Some of the key changes include:

- Corporate Tax: Recent reforms have introduced clearer guidelines on corporate tax rates and deductions. The general corporate tax rate remains at 22.5%, but certain sectors, such as oil and gas, face higher rates. New incentives have been implemented to encourage investment in key industries like manufacturing, technology, and renewable energy.

- Value-Added Tax (VAT): The VAT rate in Egypt is currently 14%. Reforms have simplified the process for businesses to file VAT returns, reducing the administrative burden on small and medium-sized enterprises (SMEs). Additionally, the Egyptian Tax Authority has improved its digital platform to facilitate VAT compliance, making it easier for businesses to report and pay VAT electronically.

- Income Tax: Reforms to income tax laws aim to reduce the tax burden on individuals and small businesses. For instance, progressive tax rates now provide more relief for lower-income brackets, while high earners contribute proportionally more. This change helps small businesses by lowering the overall tax burden on their owners and employees.

These reforms reflect the Egyptian government’s commitment to creating a more dynamic and competitive economy, but they also require businesses to stay updated with the evolving tax landscape.

How the Reforms Affect Different Sectors

The impact of these reforms varies across industries, with some sectors benefiting more than others. Here’s a closer look at how different sectors are affected:

- Manufacturing: Businesses in the manufacturing sector benefit from new tax incentives aimed at encouraging local production. These incentives include tax breaks for companies investing in machinery, technology, and infrastructure. Additionally, manufacturers exporting goods may enjoy reduced tax rates under specific government programs.

- Technology and Innovation: The Egyptian government has introduced several incentives to promote investment in technology and innovation. Startups in sectors like fintech, software development, and artificial intelligence can benefit from tax deductions and simplified compliance processes, making it easier for tech entrepreneurs to scale their businesses.

- Real Estate: The real estate sector has also seen changes in how taxes are applied, particularly concerning property taxes and capital gains. Real estate companies must stay vigilant to ensure compliance with new regulations affecting property sales, leasing, and development projects.

These sector-specific reforms highlight Egypt’s efforts to attract foreign investment and boost domestic production, but they also require businesses to carefully monitor how these changes affect their tax obligations.

Steps Businesses Should Take to Stay Compliant

With these tax reforms in place, businesses need to be proactive in ensuring compliance. Here are some steps businesses can take to align with the new regulations:

- Update Your Financial Records: Ensure that all financial records are up to date and accurately reflect your business’s operations. This includes keeping detailed records of income, expenses, and tax deductions to ensure you’re prepared for tax filing season.

- Review Your Tax Strategy: Consult with tax professionals to reassess your tax strategy and identify opportunities for deductions or incentives that may benefit your business. Staying informed about new tax laws can help you optimize your tax position.

- Use Digital Tools: Take advantage of Egypt’s digital tax platforms to streamline compliance. Filing VAT returns and corporate taxes electronically not only saves time but also reduces the likelihood of errors or missed deadlines.

- Stay Informed: Tax laws in Egypt continue to evolve, so it’s important to stay informed about future reforms and changes. Subscribe to newsletters or consult with tax advisors to keep your business up to date on the latest developments.

By taking these steps, businesses can avoid penalties and ensure they are taking full advantage of the incentives and benefits offered under the new tax laws.

Benefits and Challenges of the Tax Reforms

The recent tax reforms in Egypt offer both opportunities and challenges for businesses. On the positive side:

- Simplified Compliance: The reforms aim to reduce administrative burdens, particularly for SMEs, by streamlining tax filing processes and encouraging the use of digital platforms.

- Incentives for Investment: Businesses in key sectors, such as manufacturing and technology, can benefit from tax breaks and deductions that encourage investment and growth.

- Increased Transparency: The reforms promote greater transparency in tax reporting, helping businesses understand their obligations more clearly and reducing the risk of tax disputes.

However, there are also challenges that businesses may face as they adjust to the new tax environment:

- Adaptation Costs: Implementing new tax strategies and updating accounting systems to comply with the reforms may require additional resources, particularly for smaller businesses.

- Ongoing Adjustments: As the government continues to refine its tax policies, businesses will need to stay flexible and adapt to further changes in regulations and filing requirements.

Overall, the tax reforms present a mixed bag of opportunities and challenges, but by staying informed and proactive, businesses can minimize the impact of these challenges and maximize the benefits.

Conclusion

The recent tax reforms in Egypt mark a significant step toward creating a more competitive and transparent business environment. While these changes offer numerous benefits, such as tax incentives and simplified compliance, businesses must stay vigilant in ensuring they remain compliant with the new regulations. By updating financial records, reassessing tax strategies, and leveraging digital tools, businesses can navigate these reforms effectively and continue to thrive in Egypt’s evolving economic landscape.

Last Update: Thu, Feb 5, 2026 11:37 PM